(Graphic: www.votesolar.org)

Hey solarDwellers:

Time magazine has an article today about how hot some Taiwanese solar/silicon IPO's have been of late. First, a comment on the following assertion made in the article, which repeats the illogical link between "oil prices" and demand for solar panels:

"[These three Taiwanese solar companies]have delivered stellar gains thanks to the world's growing appetite for solar power as a hedge against the high price of crude."Hybrid, and more fuel-efficient cars are more of a hedge against oil prices than solar panels. Oil really isn't related to solar panels, since oil is mainly for agriculture and transportation, not electricity production. It's more logical to say that solar is a hedge against rising natural gas/coal/nuclear prices, since THOSE are the fuels that are the main inputs for electricity production.

Slowing of solar company profits: Although we've been hearing about the solar panel/silicon shortage lasting until 2007 or 2008 when production can catch up to all this solar demand, it's interesting how the article points out that with so many new panel manufacturers entering the market, this new supply will quickly "outstrip" the demand being created by the new California Solar Initiative 10-year rebate program. More competition will add pressure to not raise solar panel prices too much, but the increased cost of silicon will squeeze profits via increased production costs. All in all, it makes it difficult to determine how much these price pressures will slow profit growth at the bigger solar panel manufacturers. We future "solardwellers" are not worrying so much about reduced profit margins, and just hoping that long-term programs like California's will help increase solar-grade silicon production so more buildings can go solar.

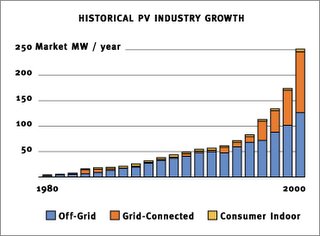

Next, it's impressive to see the goal of the California plan to install 3000MW of solar over the next 10 years in context: "which is more than the total cumulative energy capacity of all solar cells that were installed worldwide at the end of 2004." Now that's ambitious, probably more than realistic, but good to be aggressive with clean energy!

Finally, I think the article makes the other common mistake of saying solar is more expensive than it really is, making it hard for solar companies to overcome that common consumer perception. The article states:

For now, subsidies are a must. Even with higher oil and energy prices, the cost of generating electricity from the sun remains at least three times more expensive than prices that homeowners normally pay their local electric utility.

But when you take a look at the 2006 survey of solar prices over at Solarbuzz.com, you see that the average installed solar price is at about .21/kWh. Northern California's baseline retail price for utility-based electricity is about .15/kWh, making solar about 45% more expensive than retail after rebates, not "three times more expensive." Yes, we still need rebates gradually decreasing each year, so that solar can be a self-sustaining market with almost no rebates, as has happened in Japan.

Please comment if you have any experience with the current "solar panel shortage." I'm curious to see how big a delay there is between a customer's order to install panels and the installer's ability to obtain those panels.

Thanks for any input,

--the solarDweller

Categories: solar, solar+energy, solar+power, sustainable, renewable, peak+oil, energy, oil, EconomicsOfSolar, WhatsNews

No comments:

Post a Comment